Unemployment Hits 50 Year Low

Wages Not Keeping Pace with Surging Employment

Overview: The biggest economic report released over the past week contained mixed news on the labor market and was roughly neutral for mortgage rates. Instead, an increase in tensions in the trade talks with China was the main influence, and mortgage rates ended a little lower.

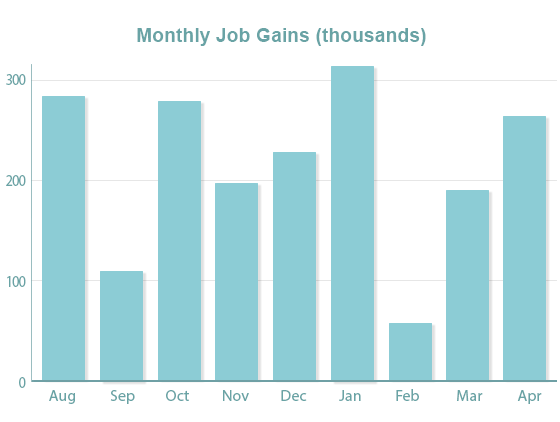

The latest Employment Report again illustrated the unusual divergence noted by Fed officials between strong job growth and subdued wage inflation. The economy added 263,000 jobs in April, well above the consensus forecast of 190,000. The unemployment rate unexpectedly declined from 3.8% to 3.6% — the lowest level since 1969. As the supply of available workers shrinks, companies typically are forced to raise salaries to attract new hires, but wage inflation still fell short of expectations in April. Average hourly earnings were just 3.2% higher than a year ago, which was the same annual rate of increase as last month. The net effect of the mixed labor market data on mortgage rates was small.

Tuesday, comments from President Trump about the trade negotiations with China caused a massive selloff in stocks. Late last week, senior administration officials suggested that a trade deal could be close, so investors were caught off guard when Trump threatened to increase tariffs on Chinese goods beginning on Friday. In response, Chinese officials have been considering cancelling the trade talks scheduled to take place later this week. Since a trade war would result in slower economic growth, which would lower the outlook for future inflation, the increased uncertainty about reaching a deal was modestly positive for mortgage rates.

Week Ahead

Looking ahead, the Consumer Price Index (CPI) will come out on Friday. CPI is a widely followed monthly inflation report that looks at the price change for goods and services. The Retail Sales report will be released on March 15. Since consumer spending accounts for about 70% of all economic activity in the U.S., the retail sales data is a key indicator of growth. The New Residential Construction report (also known as Housing Starts) will come out on March 16. In addition, news about the ongoing trade negotiations between the U.S. and China could continue to affect mortgage rates.